Managing electricity price volatility

Meeting customer and regulatory expectations.

DOWNLOAD THE PAPER

Introduction

Electricity prices and price volatility in the Australian National Electricity Market have both increased significantly over the past two years, driven by transformational changes to the electricity generation mix and fuel costs. Electricity costs represent 30% of Lower Murray Water’s rural irrigation business controllable costs. Therefore, the increased prices and volatility represents a major risk to the corporation and its customers. Lower Murray Water has collaborated with its customers and worked closely with the regulator, the Essential Services Commission, to develop an electricity price collar mechanism designed to protect the sustainability of the rural business from electricity price volatility.

Year case study was implemented

2018/19

Case study summary

Lower Murray Water’s (LMW) rural business comprises about 2800 small-to-large agricultural businesses that compete mainly in global markets. Table grapes, dried fruit, citrus, avocados and wine grapes supply markets in Asia and Europe. Growers are acutely aware of the need for both quality and cost competitiveness of their products. The reliability of LMW’s infrastructure to deliver water is crucial to maintaining quality. Because horticulture requires long term investment, customers value price stability as well as price competitiveness.

LMW pumps water from the Murray River and delivers water through a network of channels and pressurised pipes. The continued sustainability of the water delivery infrastructure depends upon LMW securing stable cashflows from its customers to fund the 20-year asset renewal and replacement master plan.

The electricity consumption of the LMW irrigation pumps peaks at around 14MW during summer. The peak pumping period coincides with the highest and most volatile electricity spot prices and the coincidence of peak load and price volatility has the effect of amplifying electricity price volatility risk.

Under the regulatory regime, LMW is subject to a revenue cap that is derived from a building block approach that includes the cost of electricity. Electricity costs are included in the revenue cap and represent a median case price forecast with a risk premium. Under this approach LMW may be exposed to the risk of extreme electricity price increases because it would, under the normal regulatory framework, be unable to pass on the associated costs to customers through price increases. This situation could seriously affect LMW’s financial capacity to undertake asset operations and maintenance and threaten its sustainability and reliability of water supply.

LMW engaged with its customer committees to develop a collar mechanism that would enable the corporation to increase water delivery prices to customers if electricity costs exceeded a pre-determined price cap. In these instances, LMW has agreed to collaborate with its customers to decide whether to increase prices to ensure that the renewal and replacement program is funded or to increase debt to provide the funding.

Similarly, LMW worked with the Essential Services Commission (ESC) to ensure that the collar mechanism met the requirements of the regulatory framework and provided transparency and proper allocation of risk.

Figure 1: Lower Murray Water operating region

Case study detail

Background

LMW operates across the municipalities of Mildura, Swan Hill and Gannawarra in North-Western Victoria, with LMW’s operating area and key services shown in Figure 1. LMW delivers irrigation and domestic and stock water services to the districts of Mildura, Merbein, Red Cliffs and Robinvale.

LMW’s operating region is highly productive, delivering $2.8 billion per annum (Mildura Development Corporation, 2018) in gross regional product to the Victorian and Australian economy. The region is relatively remote and covers a large geographic area extending over 300 km along the lower Murray River, in the driest part of Victoria.

Regulation of the rural business

While LMW manages its rural and urban businesses as a single business entity, prices for these businesses are regulated under two different regulators and regulatory frameworks. The Essential Services Commission (ESC) regulates the LMW rural business within the regulatory framework set by the Australian Competition and Consumer Commission (ACCC) and under the Commonwealth’s Water Charge (Infrastructure) Rules 2010 (WCIR).

The ESC has recently approved the LMW FY19 – FY23 pricing submission1 including use of a revenue cap form of price control to manage rural prices. A revenue cap exposes LMW to the risk of unexpected increases in costs as it is unable to recover these costs from its customers. One of the key risks identified was the risk of material increases above the forecast electricity prices.

Outcomes for customers

Customers were engaged early in the planning process to determine the most important and highest priority outcomes they required. This was an essential part of the ESC’s PREMO framework for the development of water corporations’ pricing submissions 2 For the rural business these were as follows:

- Supply me with water when I need it. The LMW irrigation districts grow a variety of table grapes, dried grapes, wine grapes and citrus. The quality and quantity of produce relies heavily on the supply of water, particularly during the few months or the year when the crops are ripening. Loss of water delivery for even relatively short periods can have a catastrophic effect on farm gross margins.

- Keep my costs to a minimum. Customers generally compete in global markets for their produce and the cost of water delivery is a significant component of their overall costs.

- Be easy to contact and quick to respond. Customers value access to LMW people, particularly during the irrigation seasons, and often require information and advice quickly.

The problem: further electricity price shocks threaten the sustainability of the rural business

The National Electricity Market and price risk

The NEM is undergoing transformational change including significant increases in electricity prices. LMW has developed a comprehensive energy and emissions strategy that aims to deliver the optimal risk/cost outcomes. This strategy has been developed in the context of the geographic location of LMW’s operations in the transmission and distribution system, the opportunities for solar developments, and future opportunities to aggregate LMW’s customer usage.

The energy and emissions strategy requires organisational learning and capability development to enable LMW to progressively design and implement initiatives to meet its objectives. Fundamental to this is capabilities associated with participation in the wholesale electricity market in the NEM.

Two characteristics of the NEM wholesale electricity prices are relevant as context for this paper:

Average price forecasts: LMW prepared the 2019-2024 pricing submission in 2017, which was well ahead of the

- regulatory period. As part of the submission, LMW proposed a progressive procurement approach for electricity purchasing compared to the previous traditional retail contracting. This approach means that LMW progressively hedges the price of electricity as the means of optimising risk and price.

LMW sought advice from an expert consultant to provide a price forecast as the basis of its pricing submission. The approach taken to forecasting price was to derive a risk adjusted expected flat price, which was then converted into peak and off-peak rates for each quarter. The Black-Scholes model 3 was used to derive a call option value to quantify the forecasting and timing related risks. This risk adjusted price was used as the base case for the LMW Pricing Submission and was approved by the ESC.

- Price volatility: Given that electricity accounts for about 30% of LMW’s controllable costs, LMW were concerned about future price shocks under a revenue cap regime. If electricity prices increased substantially above the base case then under a revenue cap, LMW would not be able to recover these costs from customers. Under such a scenario, LMW would need to increase its debt level to fund capital works or, alternatively, defer these works.

Either option threatens the sustainability of the rural business as well as the reliability of supply of water when the customers need it. To address this risk, LMW proposed a collar mechanism as a trigger to secure additional revenue from customers during high electricity price events.

1 Lower Murray Water Urban and Rural Water Corporation 2017: Pricing Submission

2 Essential Services Commission: Performance, Risks, Engagement, Management and Outcomes

3 Options pricing models – Australian Stock Exchange (ASX)

Context for Lower Murray water sustainability

LMW has defined a capital works program to renew the water delivery infrastructure over a 20-year horizon. The planning period was determined through engagement with the LMW customer committees and was selected to both optimise the capex/opex expenditure and ensure that the infrastructure was reliable to deliver water when customers needed it for their crops.

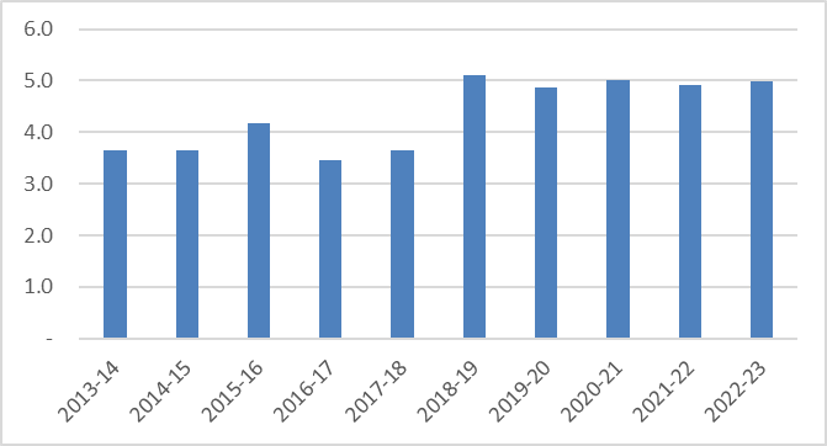

Following engagement and discussion with customers, LMW increased its renewal program from around $700,000 per annum to $1.4 million per annum. In comparison, LMW’s electricity costs are forecast to rise from around $3.5 million per annum in 2018 to over $5.0 million (Figure 2). Clearly any further increases of similar magnitude would restrict LMW’s financial capacity to deliver planned outcomes for customers.

The solution: electricity price risk sharing with customers

Figure 2: LMW historic and forecast electricity costs ($ millions)

Collar and off-ramp mechanism

To protect the sustainability of LMW’s rural business LMW proposed a price adjustment mechanism for electricity prices whereby deviations from the electricity price forecast basis for the submission, outside of an upper and lower bound (or ‘collar’), would trigger an adjustment to usage charges for customers.

Upper and lower bounds of the ‘collar’ of plus or minus 10% were proposed, which implies that LMW would absorb a financial impact up to around $500,000 before passing through an adjustment in prices to customers.

Once the trigger has been reached, the adjustment would be calculated by multiplying a portion of the incremental energy price by the forecast electricity usage in MWh. To avoid a full pass-through, the adjustment mechanism passes through only the additional costs over the trigger plus half the additional costs that follow from electricity prices reaching the trigger point.

Less than full pass through of costs will ensure that LMW does not simply rely on passing through any and all cost differences between the actual and forecast onto the customer, and will be motivated to negotiate the lowest possible total electricity price as well as minimising energy use where possible.

LMW considers that the proposed adjustment mechanism meets the requirements of the WIRO 4 because:

- Less than full pass through of increased electricity costs creates incentives for LMW to pursue efficiency improvements (WIRO cl 8(b)(iii)) and promotes efficiency within LMW (WIRO cl 8(b)(ii))

- Adjusting the volumetric price (which is directly influenced by the cost of pumping water) promotes the efficient use of services (WIRO cl 8(b)(i)) and provides signals about the efficient costs of providing services (WIRO cl 11(d)(ii))

- By protecting LMW from the adverse financial impact of a very significant escalation in costs, the adjustment also protects the financial viability of the industry (ESC Act s8A(b)).

4 Water Industry Regulatory Order 2014

The concept and possible price scenarios developed in LMW’s pricing submission (PS4) are shown in Figure 3, with the details provided in Attachment 1.

Figure 3. Price Adjustment Scenarios

Under Scenarios 1 and 4, LMW would pass on a proportion of the energy price increase/decrease. Under Scenarios 2 and 3, LMW would absorb additional energy costs/savings, although it would be open to LMW to pass on the full savings of a price decrease.

The effect on prices to customers would be spread across the remaining years of the price review period, so that if electricity prices were increased by say, 20% above the base case in 2018/19, then usage charges for customers would be increased by $0.1807 per ML for the years 2019-20 to 2022-23.

The advantage of this mechanism is that LMW is protected from large unforeseen electricity price increases, and this protection enables LMW to incorporate lower energy prices in its Price Submission to the ESC than would be possible without some form of risk sharing.

LMW proposed that the mechanism operate through the ‘unders and overs’ mechanism of the WCIR.

The mechanism necessarily operates with a lag, with actual changes in energy prices resulting in an adjustment to prices to customers in the following year (if the collar is passed). Actual energy costs per MWh for the financial year will not be known in time for the price adjustment to be assessed, so LMW proposed that the movement in energy prices on a February to January year be used as the basis of determining the energy price increase.

ESC viewpoint

In its draft determination, the ESC intially rejected the proposed collar mechanism for two reasons outlined below, but invited LMW to engage to clarify these matters:

- That it was already part of the risk adjusted price.

The ESC engaged its own consultants who agreed that the mechanism proposed was aimed at the long-term sustainability in the event of significant price shocks.

- That it was not easily understood by LMW’s customers.

LMW engaged with its customer committees to explain in detail the mechanism and to seek support to have the mechanism included in the ESC determination. This involved building on several previous sessions with customers on the overall electricity purchasing strategy and risk management. If the collar triggered, then one of the key factors for customers was that the customer committees would be engaged to recommend to the LMW their preferred course of action. The spectrum of options may include short-term deferral of capital works or increasing prices to recover the costs while preserving the capital works program.

Following discussion on the collar mechanism and the relevance to LMW and its customers, the ESC’s final determination was as follows :

In response to our (ESC’s) draft decision, Lower Murray Water requested that the commission reconsider its draft decision, and approve the proposed pass though mechanism for electricity costs. In support of this, it noted:

- Its business is particularly exposed to electricity prices. Electricity prices account for over 30 per cent of the corporation’s controllable costs for the rural business, and around 10 per cent of costs for the urban business.

- Electricity price uncertainty continues to exist.

- Since the draft decision, it sought customer committee member views on the proposed mechanism. The feedback was that committee members thought the adjustment mechanism was an appropriate option for addressing the energy requirements of the business.

Given the above, our final decision accepts Lower Murray Water’s proposed electricity cost pass through mechanism as it:

- is supported by its customer committees,

- is symmetrical – if it is triggered then customers would benefit from lower electricity prices (and would pay more if electricity prices rise),

- is consistent with providing for the financial viability of Lower Murray Water (given the cost exposure of the business to electricity prices),

- will continue to provide incentives for Lower Murray Water to manage electricity costs, given the mechanism will only be triggered if electricity costs were to increase substantially above forecast.

The ESC considered the approach was a good example of a business taking on an innovative approach to risk management. This is consistent with the objectives of the risk component of PREMO pricing framework which sought for businesses to manage risk on behalf of customers.

The resulting approach lowered electricity costs forecasts compared to adopting a conventional approach but provided protection to LMW that if prices were to escalate beyond a set point then there would be a sharing of cost increases with customers. The approach was designed to symmetrically balance risk in that customers will share in the benefits from any major falls in electricity costs.

The LMW approach contrasted with many previous proposals by water businesses put to the ESC around pass through mechanisms for electricity prices which were asymmetrical in that they sought to pass through the expectation of high energy prices or to adjust for any materially higher electricity prices. Whereas LMW proposal was a more sophisticated approach which sought to deliver lower prices to customers while symmetrically balancing the electricity price risks with customers.

The outcome: improved risk management and sustainability

The primary purpose of the collar mechanism is to maintain the sustainability of the rural business by addressing the potential threat of high electricity prices. In a broader sense, the proposed mechanism will facilitate organisational and customer learning about the electricity markets by providing an incentive for sourcing electricity at the lowest cost. This is a fundamental strategic capability required for LMW to achieve its objectives.

LMW is now in a position where it has a means of managing electricity price increases and still maintain the important outcomes for customers through investment in the water delivery infrastructure. The engagement process for reaching agreement between the ESC, LMW and customers also enabled the parties to understand, discuss and address the issues stemming from the differing perspectives in a constructive manner. For LMW and its customers, the transparency and openness of the process was important for building trust, which in turn facilitated a mutually beneficial outcome.

Attachment 1. Electricity cost pass through mechanism

About the authors

Andrew Kremor | Andrew is the General Manager, Customer and Stakeholder at Lower Murray Water Urban and Rural Water Corporation. Andrew is also an inaugural Director of Zero Emission Water. Andrew is responsible for oversight of LMW’s rural business, and LMW’s communications and electricity procurement. Previously, Andrew has held senior management or board roles in Santos, Babcock and Brown Power (now Alinta Energy), Energex Limited, Energex Retail, Tarong Energy, Ernst & Young and ETSA. Andrew’s expertise is in public and private sector infrastructure development and management and wholesale and retail energy and renewable markets.

Marcus Crudden | Marcus is the Director, Price Monitoring and Regulation at the Essential Services Commission. Marcus is responsible for leading the commission’s pricing and regulatory work program across local government, transport and water sectors, and the establishment of retail energy pricing under the Victorian Default Offer. Marcus was responsible for leading the development of the commission’s new approach to water pricing (PREMO) and for the assessment of water price submissions.

Brendan Warman | Brendan is the Manager, Planning and Regulation at Lower Murray Water Urban and Rural Water Corporation. Brendan leads a team that provides financial planning and price regulation compliance for Lower Murray Water within the Water Industry Regulation Order and Water Infrastructure Charge Rules frameworks. Brendan was a lead contributor to the 2019-2023 pricing submission aligning pricing and agreed service levels with customer and stakeholder strategy and business objectives under the new water pricing approach (PREMO). Brendan has broad knowledge of the Victorian water industry, working within the industry for the past 25 years.

References

Australian Stock Exchange website – Options pricing models.

Essential Service Commission, October 2016: Water Pricing Framework and Approach – Implementing PREMO from 2018.

Essential Services Commission, June 2019: Lower Murray Water final decision – rural services.

Lower Murray Water Urban and Rural Water Corporation 2017: Rural Pricing Submission to the Essential Services Commission.